I do find them interesting as breadth indicators though. I don't like to use these type of indicators as overbought warnings because overbought seems to stay overbought for so long, especially in a bull market. So I think these are great indicators to keep in your back pocket during "scary" times. Here's his latest, from yesterday: Above the 40 (February 9, 2018) – A Stock Market Reset , in which he points out that T2108 "dropped as low as 8.6% before closing at 14.6%" last week. Duru is a huge fan of T2108 and writes about it frequently.

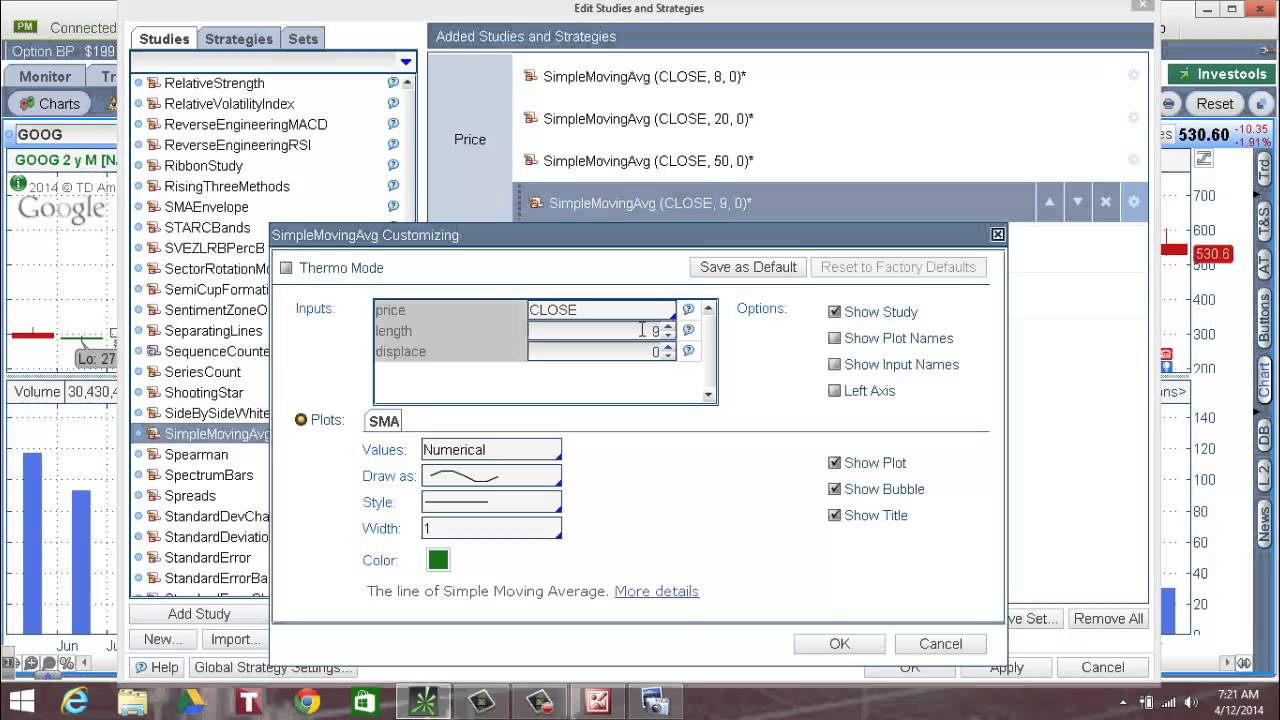

I want 'SMA20' + value of SMA20, color to be green. I want the color to be red no matter what the value is.

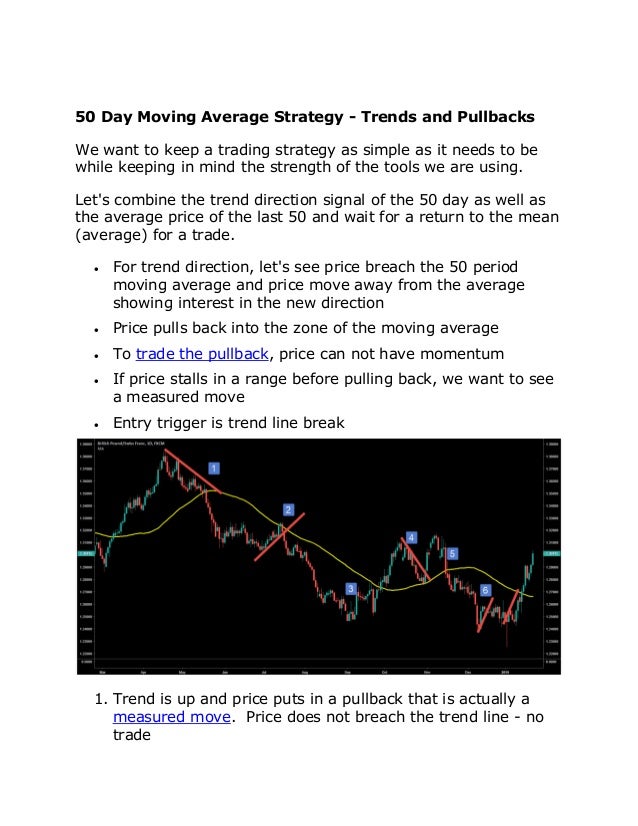

I just want it to show up as 'SMA 10 ' + the value of SMA10. So I'll likely cover or tighten my stops on any short positions and maybe start a buy list when I see the indicator get near or below 20. rad14733 all I want is for my moving average study to show on the add labels, I use the same color for my 10, 20,50,100,200 day SMA. Like, I said, I like to use it as a warning of a short-term bottom being near. ( But it does show that you're likely to be wrong to make bearish bets with the indicator under 20 - unless you're making very short term trades). The dip around October 2009 shows that this isn't some magical indicator that guarantees THE BOTTOM has been put in. Below 20 is accumulate & below 10 is oversold (buy) (Click the image to view a larger version)Ĭlosed at 18.2 on Friday & 13.6 on Thursday, the lowest since 1/20-1/21/16 at 9.0 & 11.8. That shows a weekly S&P 500 chart plotted against the percentage of S&P 500 stocks above their 50-day moving averages. That is, once the percentage drops to or below 20, the market is oversold and is likely to stage a short term bounce in the near future.Īn old stock bloging buddy, Chris, tweeted the following chart yesterday, which nicely illustrates this phenomenon. The difference is that mine takes all stocks into account (not just NYSE stocks) and it uses the 50-day moving average. When I built this site I wanted something similar, so I went with the indicator you see on the General Market Overview page.

50 DAY MOVING AVERAGE THINKORSWIM SOFTWARE

I first learned of it in the early 2000's via Worden's software - they have an indicator called T2108, which is the percentage of NYSE stocks above their 40-day moving averages. I love to use it as an oversold indicator during market selloffs. If you've visited the General Market Overview page or watched my Chart Notes page for a while you've seen the % of Stocks Above Their 50-Day Moving Averages indicator.

0 kommentar(er)

0 kommentar(er)