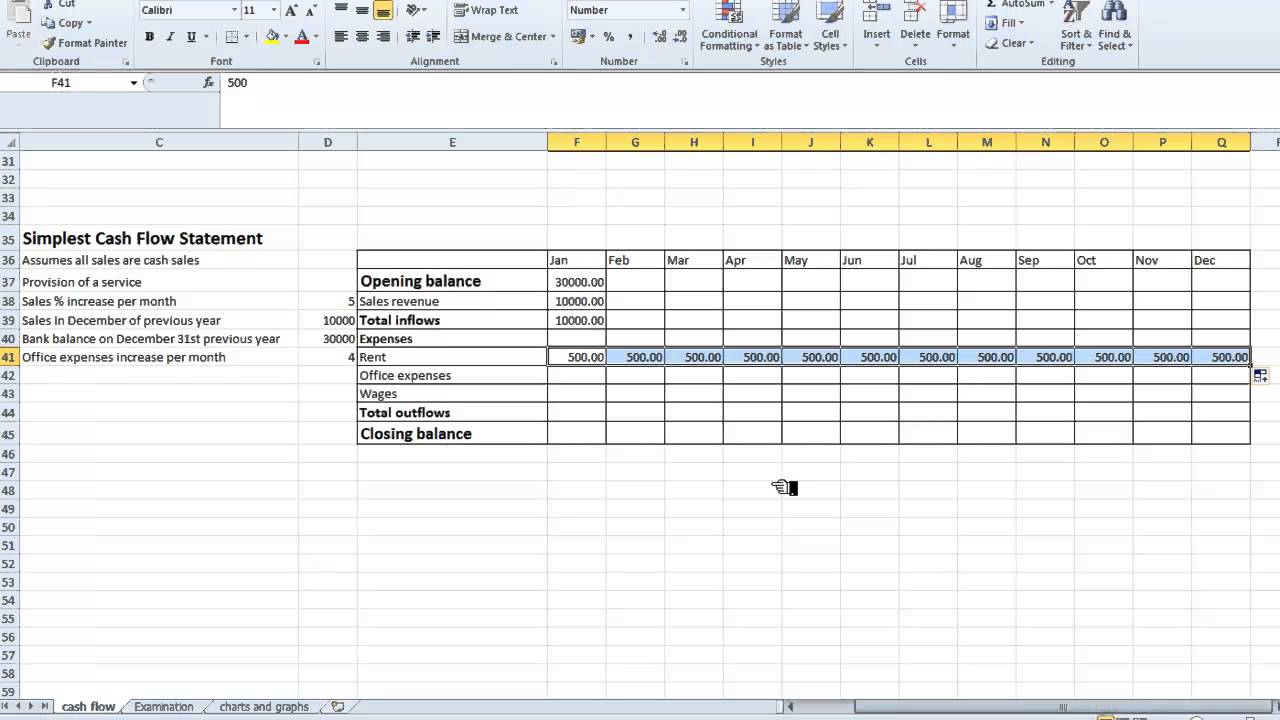

When the current asset increases, cash is used to buy current assets. Step 3: Adjust the changes in Current Assets. So depreciation of $50,000 should be added back with the Net Profit of $800,000. Step 2: Adjust Non-Cash Expenses already deducted from the Accounting Net Profit. In the above question, the firm’s Net Profit is $800,000. Step 1: Start from the Accounting Net Profit of the Firm.

Examples of Cash Flow Statementsįollowing are the examples are given below: Example #1Ĭompany XYZ is a steel manufacturing company. Similarly, investing and financing concentrate on where the company invests cash and how the company generates cash, respectively. Operating Cash Flow shows the cash inflow/outflow from the firm’s operations. There are three types of cash flow statements, each dedicated to showing the picture of a particular firm segment. Any transaction recorded as per accrual accounting and has affected the firm’s net profit is reversed in the cash flow statements. The Cash Flow Statement concentrates on the transactions where cash is involved.

#Cash flows statement template free

Start Your Free Investment Banking Courseĭownload Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others Explanation

0 kommentar(er)

0 kommentar(er)